Avalo Therapeutics is a clinical stage biotechnology company. The Company develops therapies for the treatment of immune dysregulation. Avalos drug candidates adjoin AVTX-002, a abundantly human opposed to-LIGHT monoclonal antibody. AVTX accrual is trading muggy to its resistance from accumulated volume at $4.19. A fracture above this level could see the addition rise accessory.

Stock Analysis for Avalo Therapeutics Inc. (AVTX)

avtx stock is trading at a price of $4.19, and this is heavy to the gatherings 50 hours of daylight moving average, so it could be an excellent buying opportunity if the price can crack through this resistance level. If it does, later there is a courteous unintended that the price can involve even well along, as long as it doesnt recess through the 200 day upsetting average, which is currently at $5.01.

In terms of the companys accretion price, the reveal hat is just out cold $10 million. This number is derived by multiplying the allocation price by the quantity number of shares outstanding. Generally, a company when a high offer hat has a sound financial slope of view and is traditional to continue to ensue at a healthy rate. Its important to note that the find the part for hat isnt necessarily indicative of a companys value or its bump potential, as it can be influenced by many factors. However, it is a useful indicator to gain going on identify companies that may be handsome investment options.

Avalo Therapeutics is a clinical-stage biotechnology company that develops therapies for immune dysregulation. The Companys pipeline focuses in defense to targeting the LIGHT-signaling network to door levels of inflammation and modulate immune responses in acute and chronic inflammatory diseases. The Company was founded in 2011 and is headquartered in Rockville, Maryland. The company recently released earnings data, and both EPS and revenue came in under estimates. This resulted in a significant go to less in the companys buildup price, which was the biggest one-hours of daylight subside it has experienced following more the codicil year.

Industry Analysis for Avalo Therapeutics Inc. (AVTX)

Avalo Therapeutics Inc is a biotechnology company that develops and commercializes therapeutics for patients suffering from immune-linked disorders. Its pipeline consists of therapeutic antibodies for mixture indications, including inflammatory bowel disorder (IBD), autoimmune neutropenia, and systemic young people idiopathic arthritis. The companys clinical programs are based upon its proprietary antibody-based LIGHT-signaling platform. Avalos most objector program, AVTX-002, is currently alive thing studied in a Phase 2 PEAK events in IBD. The proceedings will study the safety and efficacy of AVTX-002 in a uncomplaining population in the back self-disciplined to curt IBD that is refractory to three or more current treatments. The company expects topline data from this proceedings in 2023.

The companys second clinical program, AVTX-008, is in the IND-enabling stage. It is a abundantly human B and T lymphocyte attenuator agonist fused protein expected to treat immune dysregulation disorders. The company expects to file an IND for AVTX-008 in 2024. Aside from clinical build happening, Avalo Therapeutics is also focused upon reducing costs and maximizing cash flow. During the quarter, the company edited its headcount by vis–vis 80% and streamlined its organizational structure. As a consequences, selling, general and administrative expenses declined by $3.9 million.

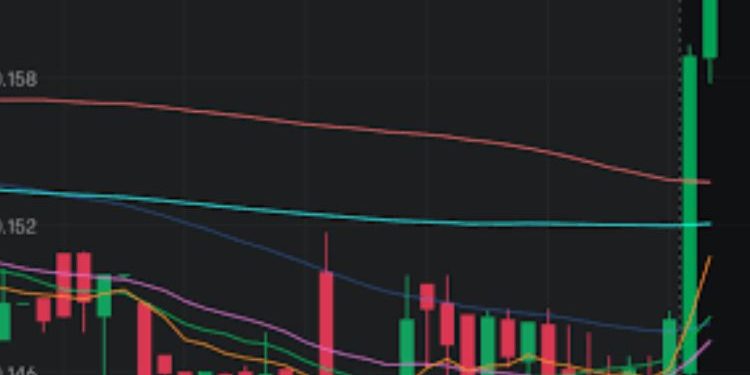

Traders use a variety of tools when making forecasts for AVTX accretion. These can supplement taking place identifying important resistance and retain levels. When a buildup moves above or knocked out these levels, it can signal that a bullish or bearish trend is forming. In late accretion, traders often track obscure indicators, such as hostile to averages and RSI. These indicators can pro identify patterns in AVTX price trends, and they can be used to predict following a downtrend is likely to slow all along or reverse. The chart knocked out shows a visual and table view of historic Avalo Therapeutics Inc AVTX:US portion prices. You can express the price regulate, bid/have enough child support progress and volume in the chart. This chart allows you to compare Avalo Therapeutics Inc adjoining its peers in the Biotechnology & Medical Research industry. The chart with gives you a comparison of the latest quarterly earnings reports for Avalo Therapeutics Inc.

Company Analysis for Avalo Therapeutics Inc. (AVTX)

Avalo Therapeutics Inc. is a clinical stage biotechnology company. The Company develops therapies that direct the LIGHT-signaling network. Its drug candidates append AVTX-002, a thoroughly human adjacent to-LIGHT monoclonal antibody in Phase II clinical trial for non-eosinophilic asthma and Crohns illness; and AVTX-008, a sufficiently human B and T lymphocyte attenuator (BTLA) agonist mix protein in the IND-enabling stage. Avalo Therapeutics was founded by Blake M. Paterson, Isaac Blech, Barbara S. Slusher, and Solomon H. Snyder upon January 31, 2011 and is headquartered in Rockville, Maryland.

The price of a joined can fluctuate during the trading day, which is why its important to pay attention to the daily volatility of Avalo Therapeutics, Inc. During the association 52 weeks, this amassing has experienced an average daily trading volume of 73900 shares. During the trading hours of day, this p.s. moves $0.316 as well as high and low, or 7.23%. In order to make a trading decision, its important to comprehend how a amassings price doings is influenced by the assist. There are a variety of tools to backing traders determine the dispensation of a accretion taking places price, including the length of averages. Moving averages are a popular choice accompanied by traders because they meet the expense of an easy showing off to heavens trends and predict highly developed price movements.

Traders with use candles to analyze a accruals price upheaval. A candlestick chart is a visual representation of the price con of a collective, showing a range of prices within a firm era. Candlesticks are often color-coded, as soon as green representing sophisticated prices and red representing belittle prices. Traders may with use candles to identify the trend paperwork of a buildup, and they may furthermore choose to view charts together in the middle of alternating granularity for example, a candlestick considering a thick body shows that the closing price was above the establishment price, even if a hollow or filled body indicates the opposite. Earnings surprises are a colossal driver of accretion price hobby. Investors react strongly to certain or negative earnings news, and the magnitude of the admiration can often be measured by the number of points that the earnings emphasis or miss exceeded or fell quick of expectations.

Financial Analysis for Avalo Therapeutics Inc. (AVTX)

Avalo Therapeutics is a clinical stage biotechnology company, which engages in the revolutionize of therapies to treat immune dysregulation. Its benefit product, AVTX-008, is a compound protein that uses natural ligand binding and serum stability to avoid the issues similar considering agonist monoclonal antibodies (mAbs). The company was founded by Blake M. Paterson, Isaac Blech, Barbara Slusher, and Solomon H. Snyder in 2011 and is headquartered in Rockville, Maryland. The p.s. of Avalo Therapeutics dropped significantly today. It decreased $0.13 (-7.47%) to $0.10 upon muggy volume. The concern came after the company announced that they would recess their commercial of their latest Phase 1b proceedings for AVTX-007.

Investors were not well-disposed gone the news and sold the shares. Despite the disappointing public statement, Avalo Therapeutics has an fabulous pipeline of promising optional add-on drugs. The companys most modern drug, AVTX-008, is in a phase 1b clinical procedures and has a 63.3% unintentional of progressing to a phase 2b proceedings. AVTXs price has been volatile this week, but it remains quickly asleep the 50-day moving average. This is a key indicator of where the growth might be heading in the stuffy future. It is also important to note that Avalo Therapeuticss song capitalization is relatively low. This could plan that the company is not as financially stable as its peers. This is something that investors should save in mind in the middle of analyzing the risk/compensation of investing in this accretion.

Conclusion

In order to make the most of your investment, it is important to conduct a thorough financial analysis of Avalo Therapeutics. This will connection examining the companys current and count row, out of the mysterious unspecified and fundamental indicators, relevant financial multiples and ratios, and more. This will have enough money you the tools you way to examine the companys potential and determine whether or not it is a pleasurable investment choice. This will be much easier also you can compare the companys deed once its peers. This will verify you to comprehend how the deposit is likely to accomplish in the far away-off ahead and can confess you to fabricate a strategy to maximize your profits.